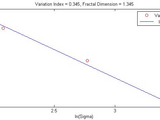

Fractal Volatility through Variation Index

[VINDX FRACDIM V_SIGMA COVERSIZE] = varIndx(LOW,HIGH)

LOW is a column vector of the lowest price in the bar (second, minute,

etc).

HIGH is a column vector of the highest price in the bar.

VINDX is the variation index of the data.

FRACDIM is the fractal dimension of the data.

V_SIGMA is the variation with interval size sigma.

SIGMA is the actual interval size. Units of sigma is index.

A minimum of 128 datapoints are recommended for best results.

Implements method outlined in this paper: http://spkurdyumov.narod.ru/Dubovikov1.pdf

The variation index method is much more efficient than box counting.

Citar como

Han (2024). Fractal Volatility through Variation Index (https://www.mathworks.com/matlabcentral/fileexchange/32399-fractal-volatility-through-variation-index), MATLAB Central File Exchange. Recuperado .

Compatibilidad con la versión de MATLAB

Compatibilidad con las plataformas

Windows macOS LinuxCategorías

Etiquetas

Agradecimientos

Inspirado por: Fractal Volatility of Financial Time Series

Community Treasure Hunt

Find the treasures in MATLAB Central and discover how the community can help you!

Start Hunting!Descubra Live Editor

Cree scripts con código, salida y texto formateado en un documento ejecutable.

| Versión | Publicado | Notas de la versión | |

|---|---|---|---|

| 1.0.0.0 |