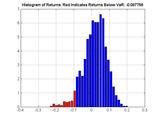

Historical Value At Risk

Versión 1.0.0.1 (11,4 KB) por

David Willingham

Calculates Historical Value at Risk for a given portfolio of returns

Calculates Historical Value at Risk for a given portfolio of returns.

E.g.

confidence_level = 0.95;

plot_flag = true;

figure

VAR_hist = computeHistoricalVaR(returns,confidence_level,plot_flag)

Citar como

David Willingham (2024). Historical Value At Risk (https://www.mathworks.com/matlabcentral/fileexchange/38848-historical-value-at-risk), MATLAB Central File Exchange. Recuperado .

Compatibilidad con la versión de MATLAB

Se creó con

R2012b

Compatible con cualquier versión

Compatibilidad con las plataformas

Windows macOS LinuxCategorías

Más información sobre Portfolio Optimization and Asset Allocation en Help Center y MATLAB Answers.

Etiquetas

Community Treasure Hunt

Find the treasures in MATLAB Central and discover how the community can help you!

Start Hunting!Descubra Live Editor

Cree scripts con código, salida y texto formateado en un documento ejecutable.